MACRS assets follow a declining-balance switching to straight-line schedule with, in general, one half-year of depreciation allocated to the first year. Two situations that affect how much depreciation is allocated to the first year are having a short first tax year and being subject to mid-quarter convention.

Short First Tax Year

For a first tax year of less than 12 months, the depreciation deduction is prorated by the number of months in the year for half-year convention assets. For example, a new entity starting on March 15th would get ten twelfths (10/12) of the half-year depreciation.

Mid-Quarter Convention

Treat all MACRS assets as if they were placed in service at the midpoint of that quarter. For example, an asset placed in service in the first quarter would be allocated three and a half quarters of depreciation whereas an asset placed in service in the fourth quarter would get one half-quarter of depreciation. This is required if more than 40% of the depreciable basis of all MACRS property is placed in service during the last three months of the tax year, regardless of the length of the tax year. A tax year of 3 months or less must use mid-quarter convention for all MACRS property placed in service that year.

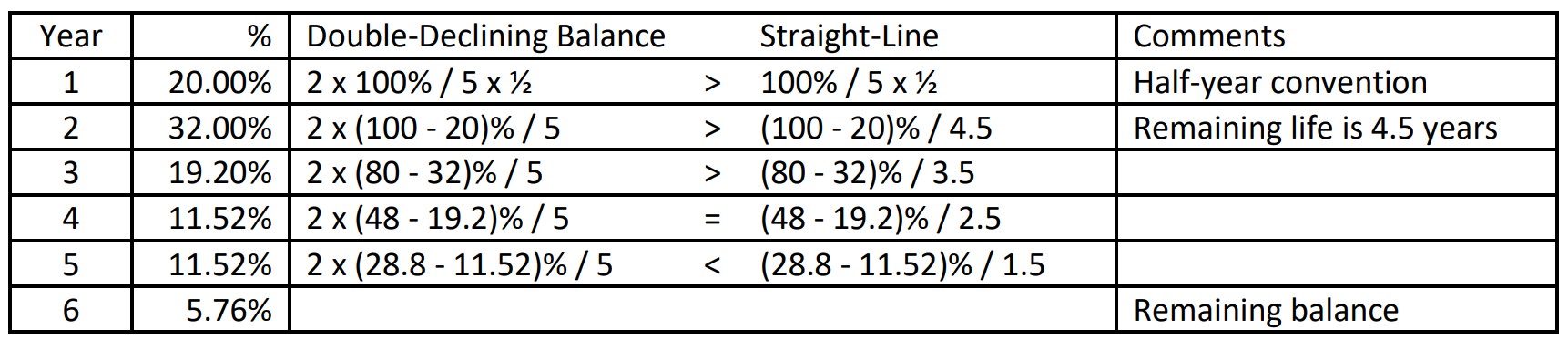

5-Year MACRS

For a 200%/SL half-year asset, the amount of depreciation in any year is the greater of either two times the declining balance or the beginning-of-year basis divided by the remaining life. The resulting schedule starts as a declining-balance schedule and switches to straight-line over the remaining life.

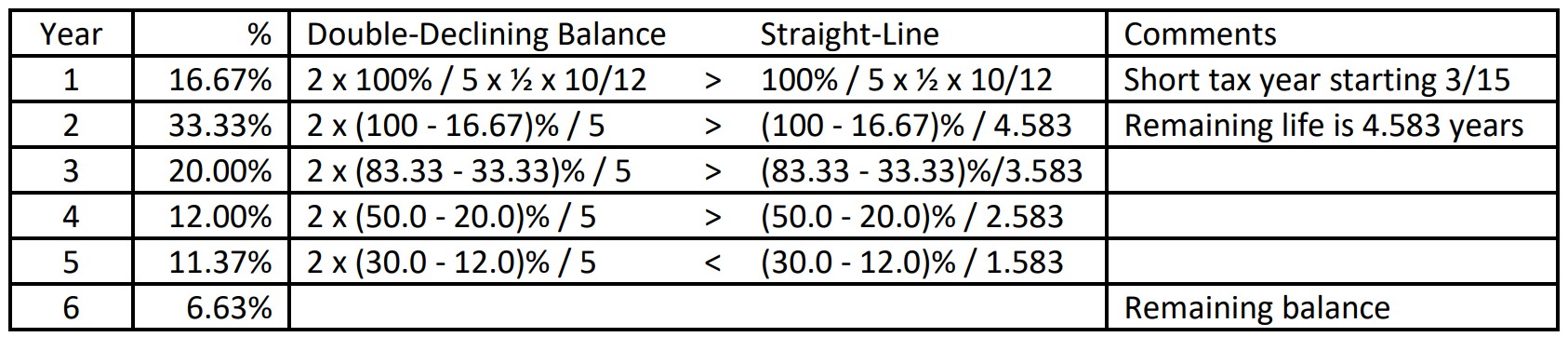

5-Year MACRS with a Short First Tax Year

The depreciation factor for the first year is prorated by the number of months in the short year. For example, a short tax year starting in March gets ten twelfths (10/12) of the normal first-year allocation.

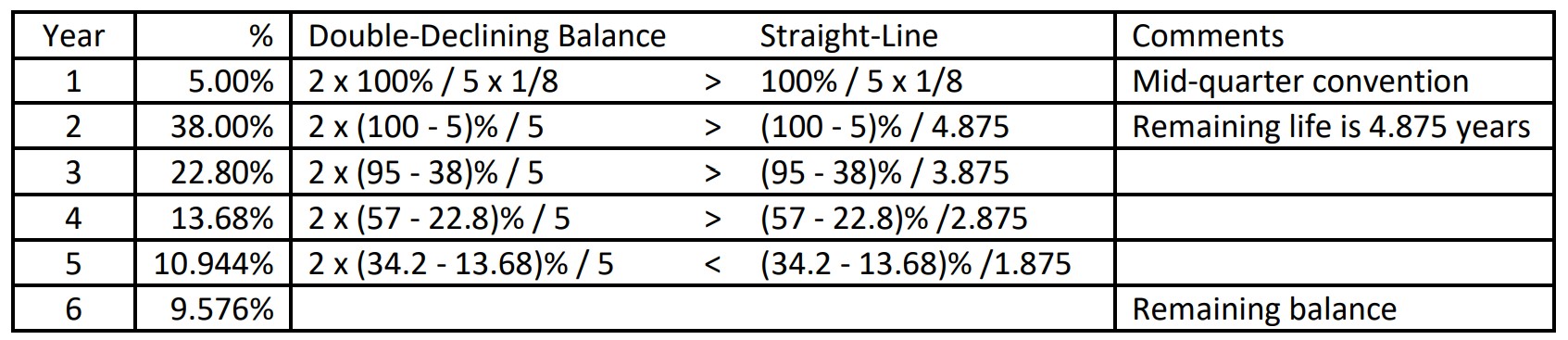

5-Year MACRS with Mid-Quarter Convention

The depreciation factor for the first year is prorated by the number of half-quarters in the year. For example, a taxpayer with no short first tax year with an asset placed in service in the 4th quarter gets half of one quarter (1/8) instead of half of a year (1/2) of depreciation.

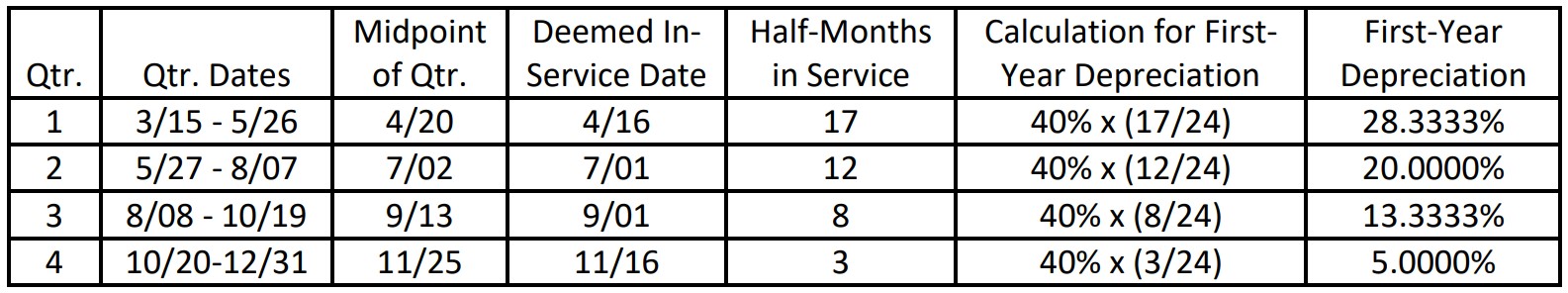

5-Year MACRS with a Short First Tax Year and Mid-Quarter Convention

The depreciation factor for the first year is prorated by the number of half-months from the deemed inservice date to the end of the year. The deemed in-service date is an adjusted in-service date that falls on either the first or midpoint of the month. The number of half-months is calculated as follows [1]:

- Find the start and end dates of each quarter by dividing the short first tax year into fourths using Actual/365 convention.

- Initially set the deemed in-service date to the midpoint of the quarter in which the asset’s inservice date falls.

- If that date is not the first day or midpoint of the month, adjust the deemed in-service date to be the nearest preceding first or midpoint of that month.

- Count the number of half-months from the deemed in-service date until the end of the tax year. The proration factor for the first year is this number divided by 24.

ABC has a macro (DEPRPROOF/SFTY_GUICALCULATOR) to help determine the deemed in-service date based on the start date of the short first tax year and the asset’s in-service date. For more information, see write-up ABC Calculator for Depreciation with Short First Tax Year and Mid-Quarter Convention.

The content provided above is intended for the informational use of our clients, and does not constitute legal or accounting advice. The material is not guaranteed to be correct, complete, or up-to-date.

[1] IRS Publication 946 https://www.irs.gov/publications/p946#idm140602893255360