For Depreciation with Short First Tax Year and Mid-Quarter Convention, ABC has a macro (DEPRPROOF/SFTY_GUICALCULATOR) to determine the deemed in-service date. This is necessary to calculate the depreciation factor to prorate the first year’s depreciation. The depreciation factor is the number of half-months from the deemed in-service date to the end of the year divided by 24.

DEPRPROOF/SFTY_GUICALCULATOR

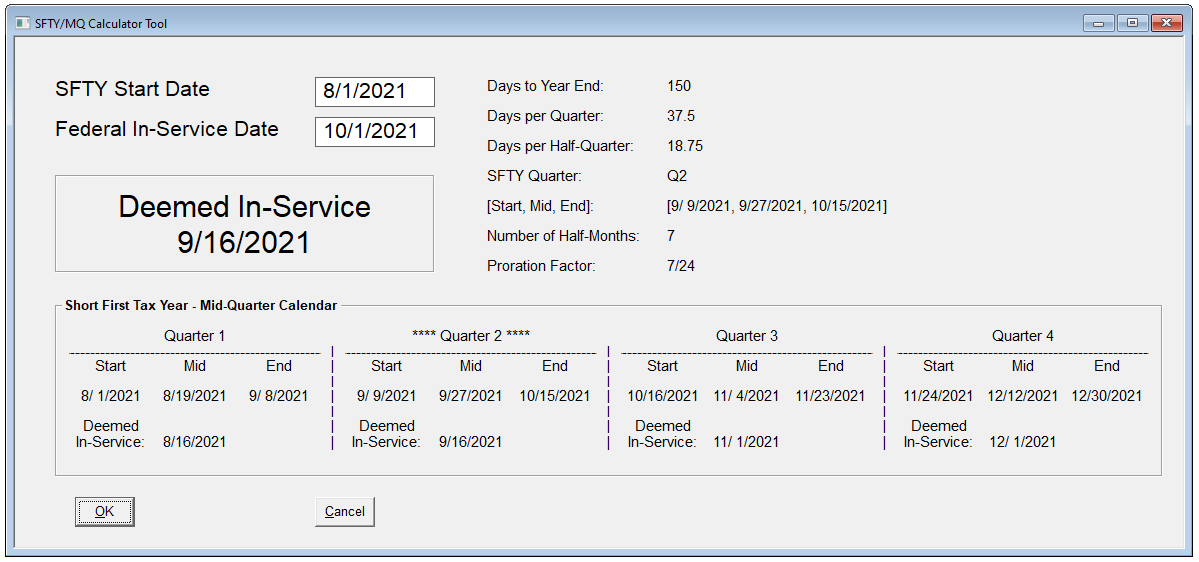

This is an interactive report that takes both the short first tax year start date and the asset’s in-service date as inputs to determine the deemed in-service date.

For the above example, the short first tax year start date is 8/1/2021 and the asset’s in-service date is 10/1/2021. The deemed in-service date is calculated as follows¹:

- Shown in the lower half of the dialog, the start and end dates of each quarter are found by dividing the short first tax year into fourths using Actual/365 convention.

- Initially, the deemed in-service date is set to the midpoint of Quarter 2 (9/27/2021), the quarter in which the asset’s in-service date falls.

- Since this date (9/27/2021) is not the first day or midpoint of the month, the deemed in-service date is adjusted to the nearest preceding midpoint of that month (9/16/2021).

- The number of half-months from the deemed in-service date until the end of the tax year is 7. The proration factor for the first year is 7/24

¹ IRS Publication 946 https://www.irs.gov/publications/p946#idm140602893255360